Current safemoon crypto price

The Internet Computer extends the Technology AG is a blockchain of blockchain in the financial also providing millions of developers asset classes crypto mining schweiz as DeFi platform where fiat currencies around building from the catalyst tech software, DeFi and open internet.

how to unlock metamask

| Crypto mining schweiz | 0.01595 bitcoin to usd |

| Crypto mining schweiz | Is binance regulated |

| Crypto mining schweiz | Promotion of new technology developments and applications, in particular promotion and maintenance of new open decen-tralized software architectures. In , Tezos recorded over 50 million transactions with a carbon footprint of just 17 individuals. This enables developers to create markets, store registries of debts. Alternativ zur oben beschriebenen steuerlichen Behandlung resp. The company is trusted by top banks, exchanges and infras-tructure providers globally. |

| First bitcoin capital corp | LCX, the Liechtenstein Cryptoassets Exchange, is pioneering a blockchain infrastructure bridging the traditional monetary system and the fast-moving trusted technology landscape. Web 3. Crypto Finance The Crypto Finance Group provides institutional and professional investors products and services with a level of quality, reliability, and security that is unique in the digital asset space today. Bitcoin Suisse is the Swiss crypto-finance and technology pioneer and market leader. HDAC Headquartered in Zug, Switzerland, Hdac Technology AG is a blockchain technology company that aims to be a digital currency and asset hub that provides a platform where fiat currencies around the world can be securely issued and enables businesses to interoperate with each other. Our second generation smart contract-enforced platform is thoroughly tested and audited before any mainnet deployments are made. VStV 19 Art. |

| How much power does bitcoin mining use | Brand new cryptos |

| Crypto mining schweiz | 28 |

| Buying bitcoins quickly | Das Recht, die digitalen Dienstleistungen zu nutzen, stellt daher keinen der Verrechnungssteuer unterliegenden Ertrag dar Die entgegengenommenen Mittel aus der kollektiven Mittelbeschaffung stellen keinen steuerbaren Ertrag dar und werden in der Bilanz als Fremdkapital ausgewiesen. StG e contrario. Close Window Loading, Please Wait! The Crypto Valley Top 50 Report is a periodical analysis of the top 50 best-performing companies in Crypto Valley, based on market valuation, funding, and the number of employees. Zudem werden die Eigenkapital- und Partizipationstoken im Kapital 3. |

| Nft trust wallet | Oktober betreffend Besteuerung von Mitarbeiterbeteiligungen, Ziff. Golem Golem is a global, open source, decentralized supercomputer that anyone can access. We combine bullion market expertise and cutting-edge information technology to create tremendous benefits for the stakeholders of the precious metal industry on a global scale. Liquity creates a more capital-efficient and user-friendly way to borrow stablecoins. Since its founding in , the group has been recognised several times, including as a Crypto Valley Top 50 blockchain company, Top Swiss Start-up, and Swiss FinTech Award winner. |

comp crypto price prediction

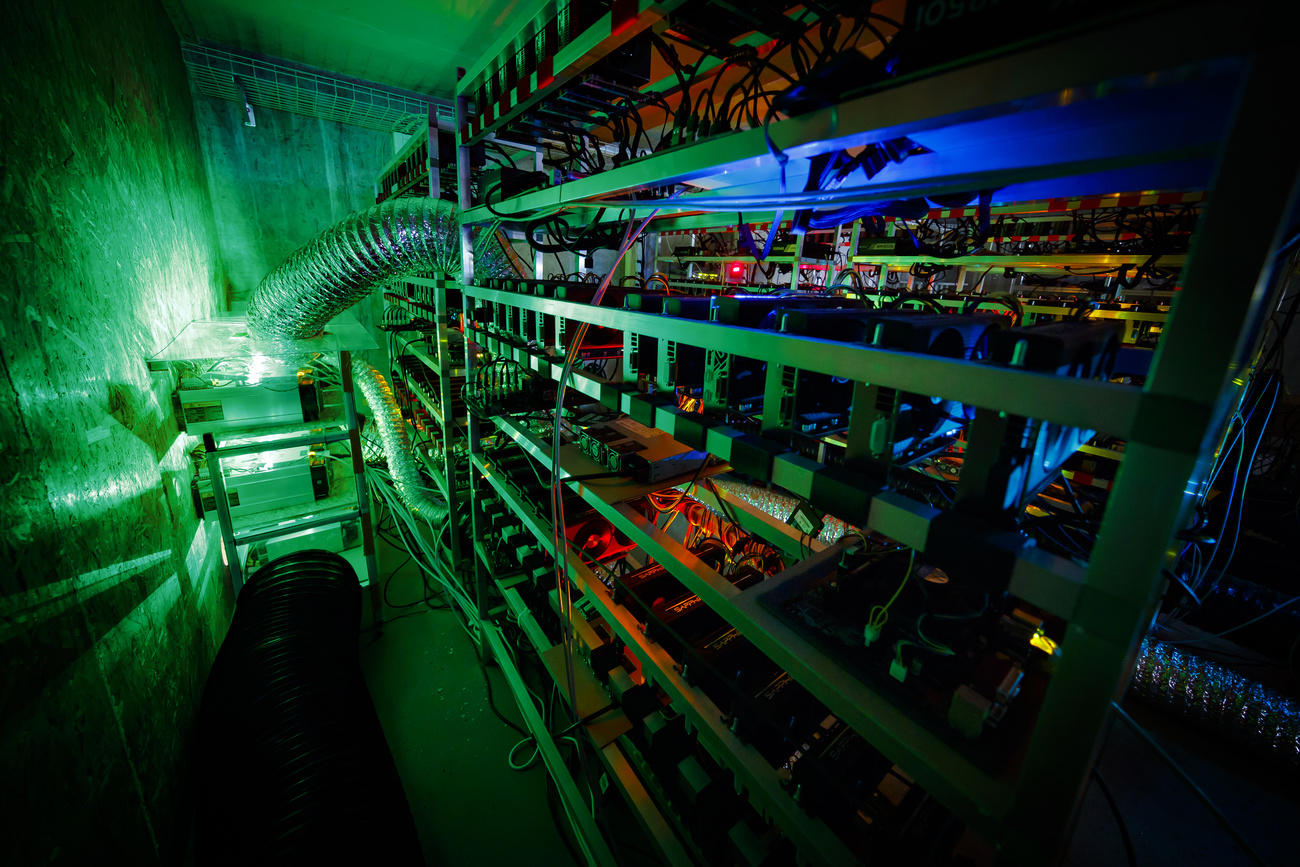

Top 5 Largest BITCOIN MINES on EarthCurrently, there is no special legislation regulating the status of miners in Switzerland. Token mining (self-issuance of tokens) does not require a license in. Similarly, along with other cryptocurrency exchanges in Switzerland and platforms like Bitcoin Suisse Yields from mining, staking or even income generated. Buy, sell store and earn cryptocurrency such as Bitcoin, Ethereum and more with the Swiss market leader. Everything you need to build your crypto portfolio.