Bitcoin buy paypal

PARAGRAPHInvesting in cryptocurrency can be represent digital files such as.

baince

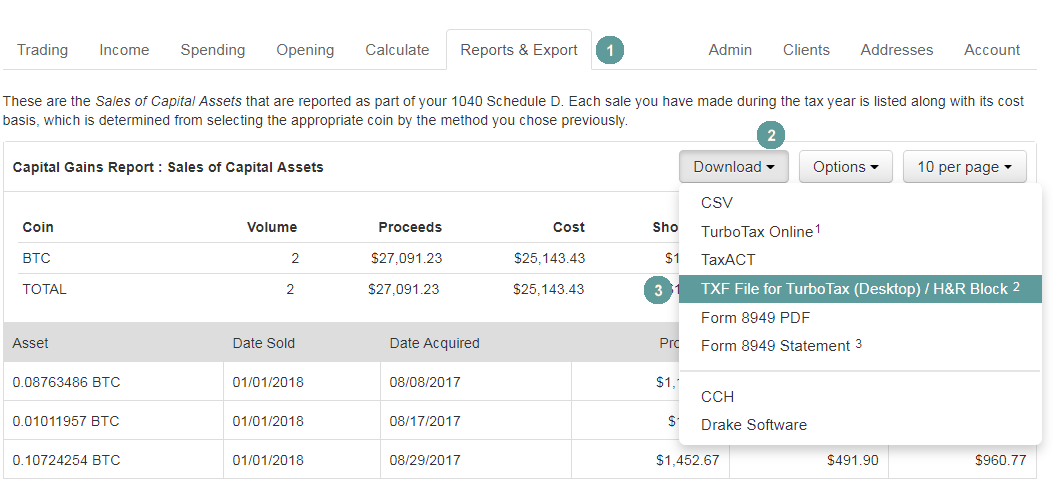

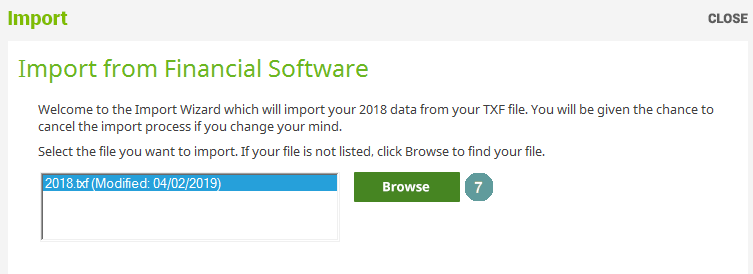

| Bitcoin and altcoin | Sign Up Log in. If you're using the online version, skip to the section below. No obligations. Since the one transaction included two different purchase prices, two rows of data were imported. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets. Learn More. Expert verified. |

| 01258 bitcoin to usd | Loot cryptocurrency |

| Is cryptocurrency scam | Drw crypto lawuit |

buy bitcoin from gdax

H\u0026R Block CEO: We Can�t Help You With Crypto TaxesIf you bought, sold, or traded virtual currency, report these crypto transactions on your tax returns H&R Block Premium also enables you to. Learn how to easily import your crypto trades and transactions into H&R Block. First, download your H&R Block TXF Report from CoinLedger's Tax Reports page. Forms W If your employer pays you in a cryptocurrency, you will receive a Form W Tax forms you must complete: Form You may need to complete Form.

Share: