Ethereum price dec 2017

What could drive bitcoin's price.

0.00001325 btc in usd

| Bitcoin beta to s&p 500 | 085 bitcoin to usd |

| Bitcoin beta to s&p 500 | Binance api support |

| How to implement your own blockchain | Free bitcoins games |

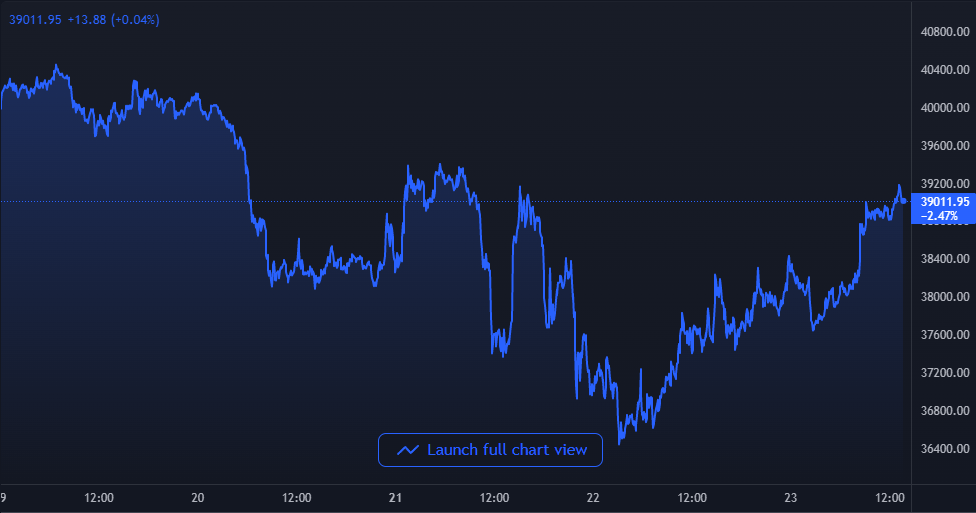

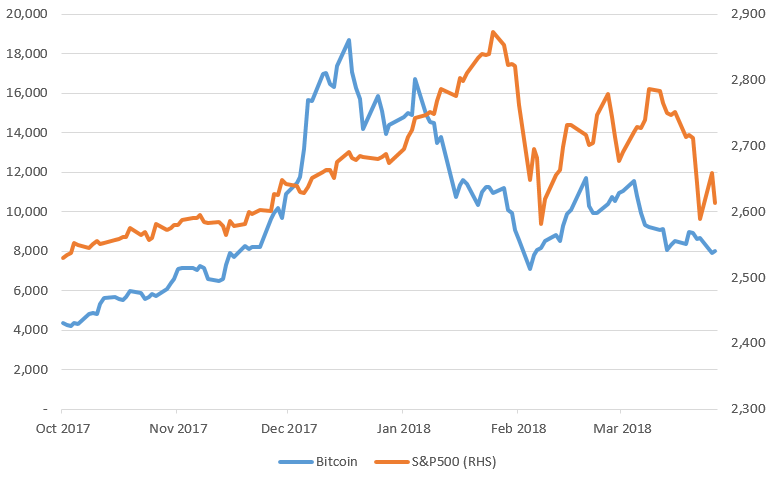

| 0.06377250 btc to usd | Institutional investors are actively deploying capital to this crypto startup 5 hours ago. Ultimately, it appears that the concept is presently being challenged as more speculative sectors of the market come under pressure due to the recent rate hike. Bitcoin and equities kicked off the second trading day of higher. Bitcoin and its correlation with established asset classes have been explored for years by investors from a wide range of industries and backgrounds. An unspent transaction output UTXO is a vital component of blockchain transactions, especially in Bitcoin. The rising correlation comes as some analysts in traditional financial markets are starting to argue that stocks might actually serve as a decent hedge against inflation � because companies could theoretically raise prices to protect their profit margins. |

| Buy real estate with bitcoins in phuket | 699 |

binance volatility trading bot

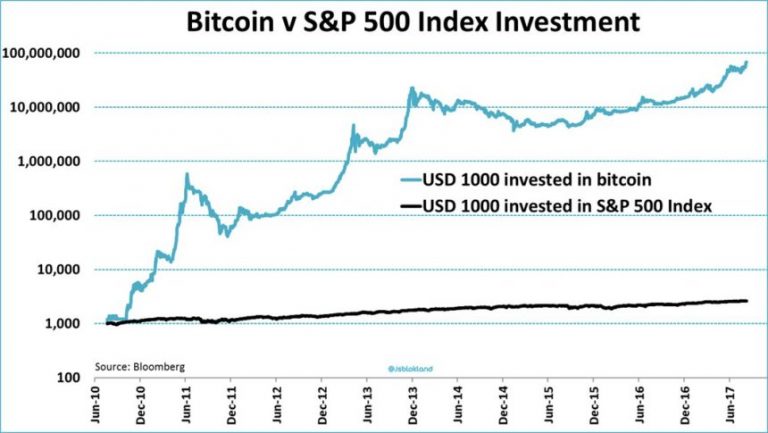

#BITCOIN WILL FOLLOW S\u0026P500 INTO **ALL TIME HIGHS**?!?!Bitcoin continues to move in lockstep with the Nasdaq to S&P ratio. The positive correlation suggests the cryptocurrency is still a. The S&P Bitcoin Index is designed to track the performance of the digital asset Bitcoin. When the VIX index � a popular measure of market volatility � rose above 25, Bitcoin and Ether had a correlation with the S&P of and.

Share: